Discover How Credit Scores Work and Improve Your Rating

Unlock your financial potential by learning how credit scores work and get tips on boosting your rating for better lending opportunities.

Discover How Credit Scores Work and Improve Your Rating

How Credit Scores Work: They want a clear path to better money choices. This guide shows How Credit Scores Work in the United States. It explains why credit scores matter in daily life and how to improve them with confidence. See more Business and Money how-tos.

A credit score is a three-digit rating, usually 300–850. It’s based on credit score calculation methods from FICO and VantageScore. These models look at reports from Experian, Equifax, and TransUnion.

Payment history is key, followed by amounts owed and credit utilization. Then, there’s the length of accounts, new credit checks, and credit mix. Scores affect loan approvals, interest rates, card limits, and even utility or cell phone deposits. For more details on habits that raise scores, see this quick primer on improving payment habits and usage.

Because reports change, United States credit scores update often. People can have different results across bureaus and models. Simple moves help: pay on time, keep utilization low, keep older accounts open when sensible, space out applications, and track progress through issuer tools or secured cards.

How Credit Scores Work: Key Takeaways

- A credit score is a 300–850 number built from credit reports via FICO and VantageScore.

- Payment history is the top driver; on-time payments protect the score.

- Keeping credit utilization low helps more than most people expect.

- Older accounts reflect a more extended history; avoid closing them without a reason.

- Limit hard inquiries by spacing applications and applying only when needed.

- Monitor reports and scores regularly to spot errors and track changes.

- Secured cards and alerts can speed progress when rebuilding credit.

What Is a Credit Score and Why Does It Matter for Everyday Life

Decisions like buying a car or getting a phone plan often depend on a three-digit number. Learning about credit scores helps people make more intelligent choices and avoid bad deals. Credit scores impact our monthly budgets, how much we need to deposit, and even our insurance costs.

Understanding credit scoring is key. It starts with the basics and gets more complex with practice. Knowing what affects your score helps you plan, compare deals, and keep borrowing costs down.

Definition: A three-digit snapshot from 300–850

A credit score is a three-digit number between 300 and 850. It shows how likely you are to pay bills on time. Higher scores mean you’re seen as less risky, often leading to better deals.

Scoring models from FICO and VantageScore use report data to give you that number. This is why credit scores are so important for big purchases.

Credit reports are the data source for scoring models

Credit reports from Experian, Equifax, and TransUnion track accounts, balances, and payments. Lenders report to these bureaus, but not always to all three. This is why scores can vary.

For more on understanding credit scoring, check out this guide from Equifax: What is a credit score. Knowing what impacts your score—like payment history and how much you owe—lets you read your reports with confidence.

Who uses credit scores: lenders, landlords, and more

Banks, credit card companies, and personal loan providers use scores to assess risk. Landlords check scores to screen tenants. Utility and cell phone providers might use them to set deposits.

Some employers also look at credit reports for specific jobs, with your consent. This shows how important credit scores are, not just for borrowing.

How scores influence approvals, interest rates, and limits

Scores affect whether you get approved, the interest rates you pay, and your credit limits. Good scores mean lower interest and higher limits. Bad scores might lead to higher costs, smaller lines, or bigger deposits for services.

Grasping credit scoring helps you make better choices. When you understand what affects your score, you can take steps to lower your interest and find better deals.

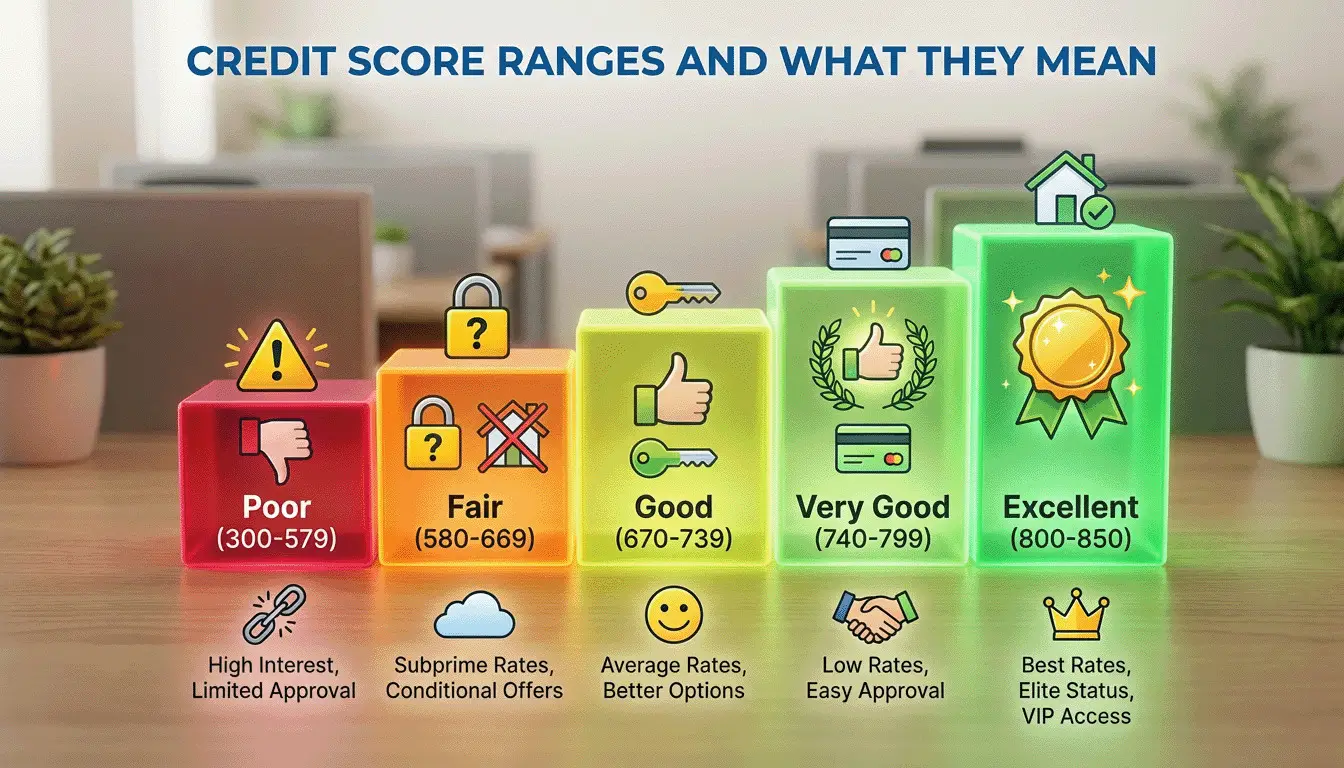

Credit Score Ranges and What They Mean

Many people hear about credit score ranges but don’t know their impact. By understanding credit scoring, they see how credit scores affect their daily money choices. This includes everything from credit cards to car loans.

FICO ranges: Poor to Exceptional (579 or less to 800–850)

FICO scores range from 300 to 850. Scores below 579 are Poor, 580 to 669 are Fair, 670 to 739 are Good, 740 to 799 are Very Good, and 800 to 850 are Exceptional. The national average is in the Good band, showing why credit scores are so important.

Higher scores mean better approval chances and lower costs. Lower scores can lead to higher rates or stricter terms. This is why knowing about credit scores is key to planning.

VantageScore ranges and how they compare.

VantageScore also uses a 300 to 850 scale with similar categories. But different models weigh factors differently. This means two people can get slightly different scores across bureaus like Equifax, TransUnion, and Experian.

For more on credit score ranges, check out how bands are defined. Also, see why scores can vary across versions. This highlights the importance of credit scores when looking for loans.

How ranges guide expectations for access and cost of credit

These ranges serve as a guide. In higher tiers, applicants often get better deals, higher limits, and lower APRs. In lower tiers, access may be limited, and total interest could increase, making budgeting harder.

By monitoring these changes, they can take action. This includes managing balances, paying on time, and tracking reports. This helps move into stronger ranges over time.

How Credit Scores Work

Credit scores are based on complex algorithms that turn data into a three-digit number. To understand them, it’s key to know the basics. Models look at payment history, balances, account age, credit mix, and recent applications. Each model’s credit score calculation weights these factors differently, resulting in varied outcomes.

Multiple models: FICO and VantageScore approaches

FICO and VantageScore examine similar categories but with their own rules. One might focus more on how much you owe, while another might concentrate on late payments. Lenders like Chase, Bank of America, and Capital One might use different versions of the same person’s credit report, which can affect the credit score calculation.

Why do people have different scores across bureaus

Experian, Equifax, and TransUnion don’t always have the same data. For example, American Express might report to one bureau before another. This is why understanding credit scoring helps explain why you might see three different scores on the same day.

Score calculations update as reports change

Scores change with new information. A payment, a lower balance, or a new inquiry can quickly update scores. Mortgage lenders might use older FICO versions, while card issuers use newer VantageScore releases. This means the credit score calculation adjusts to both the data and the model used.

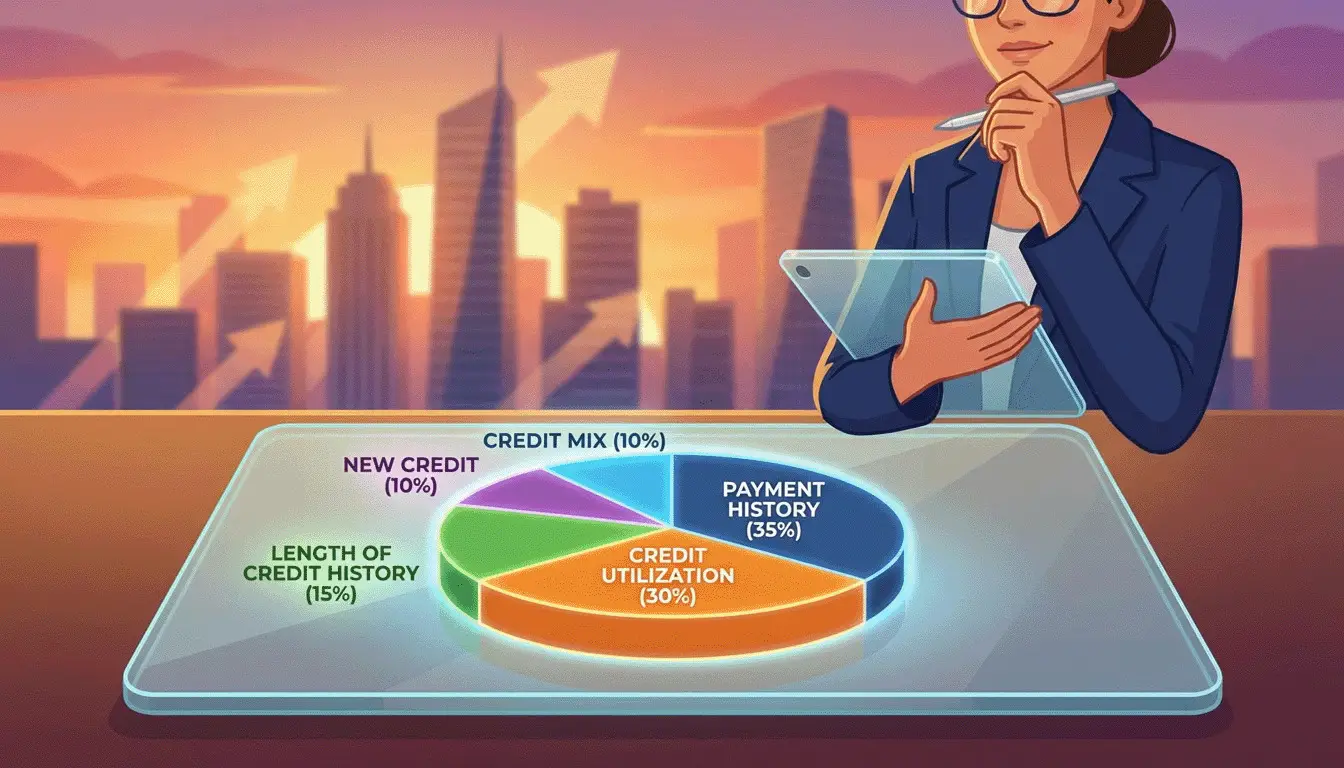

Credit Score Factors That Carry the Most Weight

Knowing what impacts credit scores helps focus on key actions. These primary factors are found in every credit score calculation. They tell lenders about risk levels.

Payment history (about 35%): on-time vs. late or missed

Payment history is the top factor. Making payments on time builds trust. But late or missed payments can quickly lower scores.

How severe, recent, and frequent these issues are also matters. This affects the credit score calculation.

Tip: Using autopay for the minimum can help avoid negative marks. It supports the most impactful credit score factors.

Amounts owed/credit utilization (about 30%)

Amounts owed focus on revolving balances versus credit limits. A lower utilization rate shows better control and less risk. Even if paid in full each month, maxed-out cards can harm scores.

Many aim to keep utilization below certain levels. This part of the credit score factors is very influential in any credit score calculation.

Length of credit history (about 15%)

Age is important. Longer accounts in good standing show stability. Lenders look at the average age and the oldest account to judge depth.

Closing a long-held card can shorten the credit history. This is part of what affects credit scores over time.

New credit and hard inquiries (about 10%)

Opening many accounts quickly can signal risk. Hard inquiries from new applications may temporarily lower scores.

For mortgages and auto loans, rate shopping within a window may have less impact. For more on how these are weighted, see this overview of credit score calculation.

Also notable: Credit mix (about 10%)—a mix of installment loans and revolving lines of credit—demonstrates debt management skills. It rounds out the key factors in modern credit score calculation and affects scores across bureaus.

What Affects Credit Scores Versus What Doesn’t

Many people wonder what impacts their credit scores. They want to know why some actions affect scores more than others. Understanding credit scoring helps them make better choices and see the value of credit scores in daily life.

Report-driven items that move scores

Changes in credit scores come from what’s in your credit reports. Key factors include payment history, credit balances, account age, credit mix, and new credit inquiries.

- Payment history: On-time payments boost scores; late or missed payments lower them.

- Utilization: Keeping credit use low is good. High balances can harm scores.

- Age and mix: Older accounts and a mix of credit types add value.

- New credit: Too many hard inquiries can temporarily reduce scores.

For more on what affects credit scores, check out this guide on what influences scores and how habits show up in reports.

Factors excluded from FICO: demographics, salary, and employer

FICO scores ignore personal traits like race, sex, and marital status. They also don’t consider income, job title, or employer. Home address and age are also not factors.

- Lenders might consider income and job when making loan decisions, but these aren’t part of the score.

- The score focuses on credit history, not personal details or employment.

Credit scores estimate risk from past credit behavior, not personal identity or paychecks.

Why non-credit bills usually don’t count unless reported

Most bills, such as rent and utilities, don’t affect scores unless they’re reported to the credit bureaus. On-time payments can help, while unpaid bills can hurt.

- Utilities and streaming services are usually not reported unless you opt in or they are sent to collections.

- Parking tickets and similar debts might appear in collections if they meet reporting criteria.

Understanding this helps grasp the importance of credit scores. Manage what’s reported and act quickly if a bill might go to collections.

Understanding Credit Scoring Models and Calculations

People want to know how lenders see risk through credit scores. These scores come from data on your credit reports from Experian, Equifax, and TransUnion. They turn this data into a three-digit number.

FICO is the most used model by lenders, but VantageScore is also popular. Each model has different versions so that scores can change. Lenders choose the version based on what they need, like for mortgages or credit cards.

The main things that affect scores are payment history, how much you owe, and how long you’ve had credit. The mix of different types of credit and new credit also plays a role. But how much each one matters can vary.

When and how data is reported also matters. Some creditors only report to one or two bureaus, and they might report at different times. This can make your score look different at any given time.

Soft pulls—like checking your score—don’t hurt your score. But, hard pulls for credit applications can lower it for a bit. Knowing this helps you plan and protect your credit.

Scores change often as your balances and payments update. By tracking these changes, you can understand how small actions can affect your score.

- FICO and VantageScore both use report data but apply distinct rules.

- Lenders’ version choices can shift approvals and pricing.

- Report differences across bureaus, explain score gaps on the same day.

- Frequent recalculations show how credit scores work as accounts update.

Practical Strategies for Improving Credit Score

Small steps can lead to significant changes. Knowing how credit scores work helps you make better choices. This section provides actionable tips to help you see progress.

Pay on time: autopay and alerts to protect payment history

Timely payments are key. Set up autopay for the minimum amount and receive alerts from your bank. If a payment issue arises, contact your lender quickly and keep paying.

This strategy is based on how credit scores are calculated. It helps improve your score over time.

Lower utilization: pay down balances, multiple monthly payments, limit increases

Using less of your available credit is essential. Try to use less than 30% of your credit limit. Paying more than once a month can also help.

Requesting a higher credit limit can also help. This increases your credit without adding new debt. It shows you understand how credit scoring works.

Build history and mix: keep seasoned accounts in good standing

Having accounts of different ages and types is beneficial. Keep old, no-fee cards active. Use them for small purchases and pay in full.

A mix of loans and credit cards is good. But be careful with bank changes, as they can affect your score.

Be selective with new credit: space out applications

Applying for credit too often can hurt your score. Only apply when necessary. For big purchases, get quotes within two weeks to minimize impact.

Space out credit card applications. Check your reports from Equifax, Experian, and TransUnion for errors. These habits help improve your score and deepen your understanding of credit scoring.

- Set calendar reminders and e-alerts to avoid missed due dates.

- Make multiple payments each cycle to tame utilization.

- Keep long-standing accounts active and free of late fees.

- Bundle rate shopping within a short window to reduce inquiry weight.

Credit Score Monitoring and Building Tools

Intelligent credit score monitoring begins with knowing how scores work and why small habits are key. They can check trusted sources for understanding credit scoring. This shows how reports create the score and why it changes over time.

A quick check-in each month helps with improving credit score while avoiding surprises. They should confirm personal details, watch balances, and note any late marks or new accounts they did not open.

Free report access via AnnualCreditReport.com

In the U.S., everyone can get free reports from Equifax, Experian, and TransUnion through AnnualCreditReport.com. Pulling one’s own file is a soft inquiry so that it won’t affect scores. Reading each report line by line helps understand credit scoring and makes it easier to dispute errors.

- Scan payment history for missed or late entries.

- Compare balances and limits across cards to keep utilization low.

- Check recent inquiries to see who viewed the report.

Score tracking from issuers and what metrics to watch

Many banks and card issuers share free score dashboards. Discover offers a Credit Scorecard with a FICO Score and plain‑language insights. Because models and bureaus differ, they should compare trends across tools rather than rely on a single number.

- Utilization: aim for single digits for improving credit score.

- Payment history: on-time payments drive most gains.

- Recent inquiries: space out applications.

- Length of history and total accounts: Avoid closing old, fee‑free cards.

Tracking these signals makes credit score monitoring more precise. It shows how credit scores work in practice as balances, limits, and payments change.

Secured cards to establish or rebuild credit

When credit is thin or damaged, secured credit cards can help. A refundable deposit sets the limit, and consistent on-time payments build positive data. Keeping statements paid in full and balances low supports improving credit score while reinforcing understanding of credit scoring through real results over time.

Pay on time, keep utilization low, and review reports often—simple moves that compound into stronger credit health.

How Credit Scores Work: Conclusion

Credit scores are a simple way to show how well you handle money. They range from 300 to 850. This score helps lenders and others decide if they can trust you with money.

Knowing how credit scores work is key. Payment history and how much you owe are the most important. But how long you’ve had credit and the mix of accounts also matter.

FICO and VantageScore models assess these factors similarly. Yet, scores can differ because of how often they update and the bureau’s view.

Good habits lead to better credit scores. Paying on time is the most significant factor. Keeping low balances and not opening too many new accounts also helps.

By following these steps, you can improve your credit score over time. This can save you money and open more doors for credit in the U.S.

Keeping an eye on your credit is smart. You can check free reports and fix mistakes early. A mix of accounts and the use of secured cards can also help.

For more on credit scores, check out this quick guide on understanding your credit. Then, use what you learn to make better choices every day.

Discover How Credit Scores Work and Improve Your Rating FAQ

What is a credit score, and how does it work?

A credit score is a three-digit number that shows how well you manage your money. It’s between 300 and 850. Scores are based on your payment history, how much you owe, and how long you’ve had credit.

Why does a credit score matter in everyday life?

Having a good credit score helps you get loans and credit cards with better terms. It also affects how much you pay for things like cell phones and apartments. A higher score means you can borrow money at lower interest rates.

How do credit reports feed into the credit score calculation?

Creditors send information about your accounts to credit bureaus. This info is then used to calculate your score. Because each bureau might have different information, your score can vary.

Who uses credit scores besides banks?

Many organizations use credit scores, including credit card companies, loan providers, and even landlords. Some employers might check your score, too, but only if it’s legal.

How do scores affect approvals, interest rates, and limits?

Lenders look at your score to decide if they should lend to you and what interest rate to charge. A higher score means better terms. A lower score might mean higher rates or even a denial.

What are the FICO score ranges?

FICO scores range from 300 to 850. They’re divided into five categories: Poor, Fair, Good, Very Good, and Exceptional. The average score in the U.S. is around 714, which is Good.

How does VantageScore compare to FICO?

VantageScore also ranges from 300 to 850 and has similar categories. Both look at your payment history, how much you owe, and how long you’ve had credit. But they might weigh things differently, which can affect your score.

How do score ranges guide expectations for credit cost?

Higher scores usually mean you can get better deals on loans and credit cards. This can save you money in the long run. Even a slight increase in score can make a big difference in costs.

How do FICO and VantageScore models differ in approach?

Both models use the same basic information but might weigh it differently. FICO also has special models for things like mortgages and cars. This can lead to different scores for the same person.

Why do people have different scores across bureaus?

Creditors report information to bureaus at different times. Some only report to one or two. This means each bureau might have slightly different information, leading to other scores.

How often do credit scores update?

Scores update whenever new information is added to your report. This can happen several times a month, depending on when creditors report. So, your score can change often.

What credit score factors carry the most weight?

Payment history is the most crucial factor. Then comes how much you owe compared to your credit limit, how long you’ve had credit, new inquiries, and the mix of your credit types. Making payments on time and keeping balances low are key.

How does payment history affect a score?

Payment history shows whether you pay on time. Late or missed payments can really hurt your score, but making payments on time helps build a strong score.

What is credit utilization, and why is it important?

Credit utilization is how much you owe compared to your credit limit. Keeping this ratio low is essential. Many aim for under 30%, and even lower is better for your score.

How does the length of credit history factor in?

Having a long credit history with good management can help your score—the age of your accounts, including the oldest one, matters. Closing old accounts can shorten your credit history.

What about new credit and hard inquiries?

Getting too many new accounts or hard inquiries can temporarily lower your score. But if you’re shopping for a car or home loan, many models treat these inquiries as a single inquiry if they occur within a short time.

What items actually move credit scores?

Factors that can affect your score include payment history, balances, account age, and inquiries. Collections, defaults, and bankruptcies also affect your score if they’re on your report.

What factors are excluded from FICO scores?

FICO scores don’t take into account factors like race, sex, or religion. They also don’t look at income or job title. But these factors might influence what lenders decide to offer you.

Do non-credit bills affect scores?

Usually, no. But if a bill is sent to collections, it can hurt your score. Some rent or utility data might be reported, but it’s rare.

How do credit scoring models and calculations work?

Models use special algorithms to turn your credit report into a score. Lenders pick which model to use, which is why scores can vary. For example, a mortgage score might be different from a credit card score.

What are practical steps to improve a credit score?

Pay bills on time, keep credit utilization low, and avoid closing old accounts. Apply for credit sparingly and check your reports for errors. These habits can help improve your score over time.

How can autopay and alerts help with payment history?

Autopay ensures you never miss a payment. Alerts from banks or card issuers can also help keep your payment history clean. This is important for your score.

What are innovative ways to lower utilization?

Paying down balances and making extra payments during the billing cycle can help. Avoiding maxing out cards is also smart. Responsible credit limit increases can also lower your utilization.

How do I build length and a healthy credit mix?

Keep old accounts open and use them occasionally. Over time, managing both revolving and installment accounts well can improve your credit mix and length.

How should I handle new credit applications?

Apply for credit only when necessary and space out applications. When shopping for a car or home loan, get quotes within two weeks to avoid multiple inquiries.

How can I monitor my credit score and reports?

Get free reports at AnnualCreditReport.com. Many banks and card issuers offer free score updates and display essential details such as utilization and inquiries.

Do secured credit cards help build or rebuild credit?

Yes, secured cards can help establish or rebuild your credit. Paying on time and keeping balances low can improve your score. After a while, you might be able to get an unsecured card.

Why might my FICO Score differ from a score shown by my issuer?

Your issuer might use a different FICO model or version. They might also use data from only one bureau. This can lead to other scores.

What affects credit scores the fastest?

Significant changes in utilization and recent late payments can quickly change your score. Paying down high balances can help, but a new late payment can drop your score sharply.

Does checking my own credit hurt my score?

No, checking your own credit is a soft inquiry and doesn’t affect your score. Hard inquiries from applications can temporarily lower your score.

What are the most essential habits for improving long-term credit?

Pay bills on time, keep utilization low, avoid closing old accounts, apply for credit wisely, and check your reports for errors. These habits can help improve your score and get you better loan and credit card terms.